A government budget is its annual financial statement containing expected revenue and expenditure for the following fiscal year (January to December).

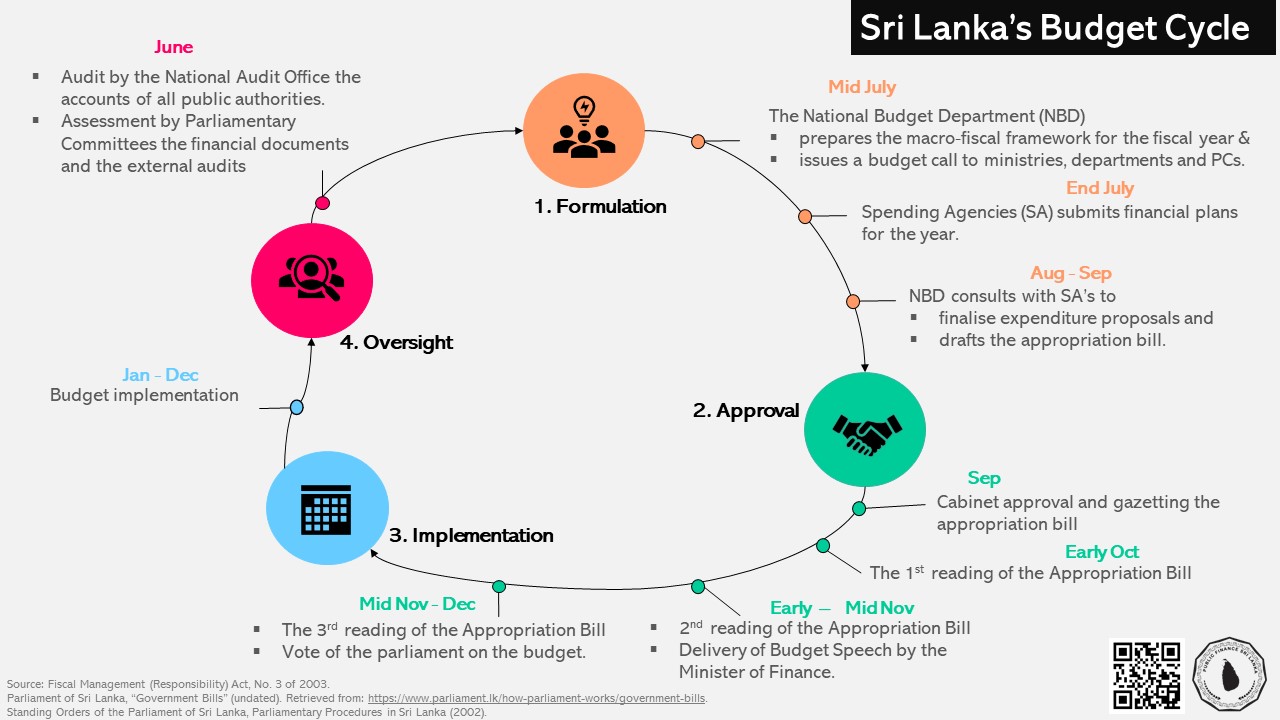

Sri Lanka’s budget cycle consists of four main stages, namely,

- Formulation – This is a stage in which the budget is drafted by the executive branch of the government.

- The National Budget Department (NBD) leads the preparation of the macro-fiscal framework. The Macro-fiscal framework is a forward-looking document that sets out three-year fiscal targets for the government. The objective of this document is to set spending agency expectations and align devolved expenditures under a single fiscal strategy. The document is presented to Cabinet for approval in early July.[1]

- In mid-July NBD issues a budget call to ministries, departments and PCs and outlines the macro discal framework and other guidelines to be met when planning for the budget.[2]

- The Spending Agencies (SA) estimate recurrent and capital expenditures using feasibility and cost evaluations of operations.[3]

- SAs are then required to submit their financial plans using the Integrated Treasury Management System (ITMIS). Followed by a consultation between the NBD and SA’s and the finalization of expenditure proposals.

- The Appropriation Bill is then drafted by the NBD and presented to Cabinet for approval.

2. Approval – Amending and approving the proposed budget by the legislative branch of government,

- The bill is then presented to the parliament. The first reading of this Bill takes place in early October.

- The Second reading occurs with the Budget Speech in early or mid-November. This speech is the most visible and publicised milestone of the budget cycle. Concurrently, draft budget estimates are published to provide the legislature with a detailed breakdown by budget heads.

- The third reading is conducted over a maximum period of 22 days. This is when committee stage debates occur, and amendments are discussed, and the Parliament votes on the budget.

3. Execution – Implementing the approved budget by the executive

- This is when the budget is implemented during the fiscal year from January to December.

- The Minister of Finance issues warrants for the release of public funds to SAs. The warrants grant agencies the authority to withdraw these funds.[1]

- SAs prepare the action and procurement plans necessary for fulfilling their programme targets and set key performance indicators (KPIs) to measure expenditure outcomes.[2]

4. Oversight – Evaluating the implemented budget by the supreme audit institution of the country and legislative branch of government

- The Accounts are audited first internally within each department and ministry unit

- The National Audit Office then audits public sector institutions at all tiers of government

- Two Parliamentary legislative committees; namely Committee on Public Accounts (COPA) and Committee on Public Enterprise (COPE), evaluates external audit reports.

- A third parliamentary committee, the Committee on Public Finance (COPF), evaluates public finance documents released during the course of the year to assess budget concerns such as revenue collection, payments from the Consolidated Fund, public debt servicing and other uses of public funds.

[1] Fiscal Management (Responsibility) Act, No. 3 of 2003.

[2] National Budget Circulars, various years.

[3] Financial Regulations, 4.

[4] Ministry of Finance and Planning – A Guide: The Budget Process (2011), and National Budget Circular No. 03/2017.

[5] National Budget Circular No. 03/2017 and State Accounts Circular No: 263/2017