Navigating Sri Lanka’s Debt

Better reporting can help – a case study on China debt

1. Introduction

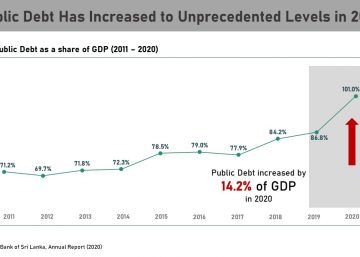

Sri Lanka has an increasingly negative trajectory of public debt. This challenge invites more focus on better information and better management of the country’s debt position and debt dynamics.

However, the initiatives and policies designed to assist Sri Lanka navigate its debt burden face an informational problem – right at the starting block: the available published data does not accurately reflect Sri Lanka’s debt burden and its distribution among external lenders. This is because Sri Lanka’s regular reporting of debt is limited to a breakdown of external debt held directly by the central government only, and excludes external debt held by other government agencies such as state-owned enterprises (SOEs).

This brief shows that the failure to factor external debt outside central government agencies leads to an underestimation of Sri Lanka’s debt. This underlying informational problem is illustrated in three sections. The first section outlines the difference between public external debt and central government external debt. The second section demonstrates the lack of visibility on the composition of external public debt figures using the example of how Sri Lanka reports its external public debt to China as a case study. The analysis exposes a loophole, by which the debt statistics can be manipulated by moving the debt from the books of the central government to the books of SOEs. The final section concludes by highlighting the critical importance of improving the reporting of Sri Lanka’s debt position to better reflect its debt dynamics and obligations.

2. Public External Debt is larger than Central Government External Debt

The Central Bank of Sri Lanka (CBSL) publishes a breakdown of the external debt of the central government. However, this is only a subset of the total public debt – that is, the debt owed by the Sri Lankan public sector to external parties, for which the Sri Lankan public is liable.

The standard definition for the calculation for public sector debt includes the debt of (i) the central government; (ii) the central bank; and (iii) public sector corporations (including deposit-taking institutions such as state-owned banks and any other state-owned enterprises).[1]

However, in Sri Lanka, government financial reports do not provide ready visibility of the composition of external public debt by indebted institution or by lender. This informational lacuna conceals the full extent of public external debt from the public. Such opacity on the actual debt position can undermine efforts towards understanding and improving Sri Lanka’s debt dynamics.

3. Case Study: Underestimating debt to China

The reporting of Sri Lanka’s debt to Chinese government entities (referred to here as simply China) serves as an illustration of this debt reporting problem. For instance, those who follow the figures published by the Central Bank are likely to conclude that Sri Lanka’s total debt to China is USD 3,387 million (LKR 615 billion) in 2019.[2] This figure was equivalent to 10% of Sri Lanka’s total central government external debt.[3] However, these numbers exclude the debt owed to China by Sri Lanka’s state-owned enterprises (SOEs).

Exhibit 1 and 2 shows that the debt owed by SOEs to China amounted to USD 2,042 million (LKR 371 billion) as of 31 December 2019.[4] When this debt is taken into consideration, Sri Lankan government’s total debt to China – that is public debt – increases by 60% to USD 5,429 million (LKR 986 billion).[5]

This example demonstrates that the failure to properly report public debt owed by SOEs can lead to a significant understatement in the reporting of Sri Lanka’s actual debt obligations.

Exhibit 01: Estimating Sri Lankan government debt to China (as of 2019) in USD millions

It also shows that a large quantum of Sri Lanka’s external public sector debt lies outside the central government with Sri Lanka’s SOEs. The problems and concerns of servicing the (unreported) SOE debt are no different from those of servicing the (reported) central government debt. Therefore, reporting only central government debt provides a misleading picture of Sri Lanka’s debt position and dynamics.

3.1 Debt accounting loophole: misleading the debt dynamics

The weakness in reporting also creates a loophole that the government can be exploited to actively conceal the actual debt obligations from the public, and create misleading debt dynamics. Exhibit 2 provides the list of loans held by SOEs. Examples from this list can be used to illustrate the loophole.

Exhibit 02: Debt owed by SOE’s to China

The reporting of loans taken for the Puttalam Coal Power Plant, Hambantota Port Development project and the Mattala Rajapaksa International Airport provide instructive illustrations of the informational problems created by shifting debt from central government to SOEs. These loans were originally recognised properly as central government debt. However, in 2014 the outstanding balances of these loans were transferred from the general treasury (central government books) to the books of several SOEs.

The loan taken for Puttalam Coal Power Plant was transferred to the Ceylon Electricity Board; the loan taken for Hambantota Port Development was transferred to the Sri Lanka Ports Authority; the loan taken for Mattala Rajapaksa International Airport to the Airport and Aviation Services (Sri Lanka) Ltd (Refer Annex 1). These movements of debt resulted in restating central government debt as a lower value, even though the actual amount of public debt was unchanged. It was an accounting sleight of hand that made it appear as if the debt had reduced.[6]

3.2 Debt accounting failures: lost in transition

With respect to the Hambantota Port Development in particular, the National Audit Office (NAO) notes that in 2017 the Hambantota Port Development debt was transferred back into the books of the treasury and taken off the books of the SLPA.[7] Contradicting the NAO, the Central Bank reports the debt as outstanding and lists it as a liability of the SLPA in its 2019 Annual Report. However, at present, the debt does not appear either in the central government books, nor the SLPA books (Refer Annex 2).[8]

The reports of the Auditor General in Sri Lanka also provide cause for concern. They suggest that the MoF makes serious mistakes with regard to counting and reporting debt correctly, even when that impacts statutory obligations. This particular example shows that debt can also get mis-counted by simply being mis-placed as it is moved around from the books of the central government to that of SOEs and vice-versa.

4. Conclusion

This brief highlights the need for improving the reporting framework on Sri Lanka’s debt. It does this by evaluating Sri Lanka’s debt position with China, where a considerable proportion of the overall debt is accounted for by SOEs, which is currently undisclosed in the regular reporting of public debt.

As Sri Lanka prepares to navigate the most challenging period the country has faced in terms of debt management, improving the reporting of debt to better reflect the actual debt position and dynamics is an important first step in the path to a solution.

[1] IMF, ‘External Debt Statistics – Guide for compilers and users’, 2014, available at: http://tffs.org/pdf/edsg/ft2014.pdf, [last accessed 03 April 2020].

[2] Converted at 2019 end year exchange rate of LKR 181.63: USD 1

[3]Central Bank of Sri Lanka, ‘Central Bank Annual Report 2019 – Table 115, 2020, available at: https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports/annual-report-2019, [last accessed 21 September 2020].

[4] Converted at 2019 end year exchange rate of LKR 181.63: USD 1

[5] Converted at 2019 end year exchange rate of LKR 181.63: USD 1

[6] Ministry of Finance Sri Lanka (MoF), ‘Annual Report 2014’, Page 146, 276 and 302, available at: http://treasury.gov.lk/documents/10181/12870/2014/a9d95930-b101-40dc-9b1b-cd1ebb2a82ba [last accessed 13 October 2020].

[7] According to the NAO this transfer is as per the Cabinet Memorandum No. MPS/SEC/2017/32 dated 20 July 2017 named “Hambantota Port Relief Agreement” the cabinet approval of which was granted on 04 August 2017.

[8] Ministry of Finance Sri Lanka (MoF), ‘Annual Report 2019: Report of the Auditor General on the Financial Statements of the Government for the year ended 31st December 2019’, Section 1.6.2.1 (a) (ii), available at: http://treasury.gov.lk/documents/10181/12870/Annual+Report+2019-20200625-rev2-eng/5952fd01-ba62-4186-a270-fe87fd87fd5c [last accessed 13 October 2020].

Annex 1: Loan transfers from the central government to the SOEs as per the Annual Report 2014.

Annex 2: Auditor General’s Report on the Hambantota Port Loan